Fasb gaap depreciation calculator

How to Calculate Salvage Value. Ad QuickBooks Financial Software For Businesses.

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

The 2021 GAAP Financial Reporting Taxonomy GRT contains updates for accounting standards and other improvements since the 2020 Taxonomy as used by issuers filing with the US.

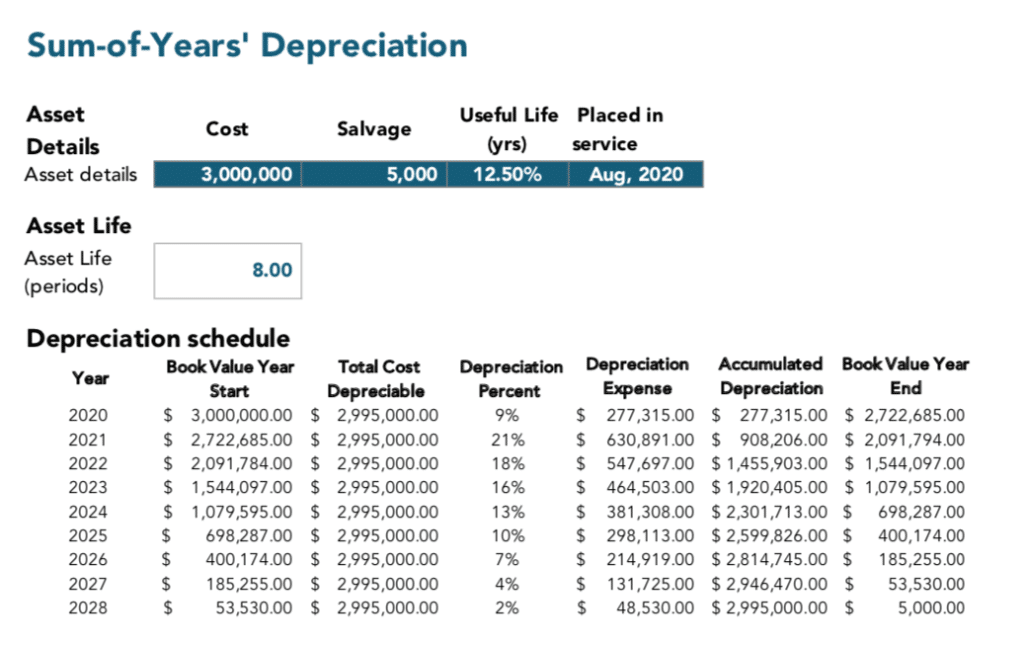

. Year 5 works a little differently. Sum-of-the-years digits depreciation. FASB Chair Richard R.

Browsing by Topic Searching and Go To navigation. Send a bond file. Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial cost.

For example the first year of an asset with three years of life would be. With a finance lease under ASC 842 the calculation methodology to calculate the amortization rate post modification follows the same methodology at initial recognition. Amortize premiums and discounts at any time.

Standards Board FASB US GAAP. The depreciation rate is then calculated by dividing the number of years left in the lifetime by this sum. Jones provides an update on quarterly activities as well as his reflections on FASB activities and priorities including stakeholder outreach.

Depreciation Calculation Depreciation is calculated using the Fixed Assets module within the SAP system. You depreciate the asset by adding the useful life years together 5. Both the IASB and FASB aim to develop a set of high quality global accounting standards that require transparent and comparable information in general.

Premium amortization discount accretion deferred fee recognition for purchasers sellers originators using CPR conditional prepayment rate. Get Complete Accounting Products From QuickBooks. Professional ViewWhat You Get.

First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8. These reports including the. Consistent with current Generally Accepted Accounting Principles GAAP the recognition measurement and presentation of expenses and cash flows arising from a lease by a lessee.

Distinguishing Liabilities from Equity. 1 Order the software. Show All in One.

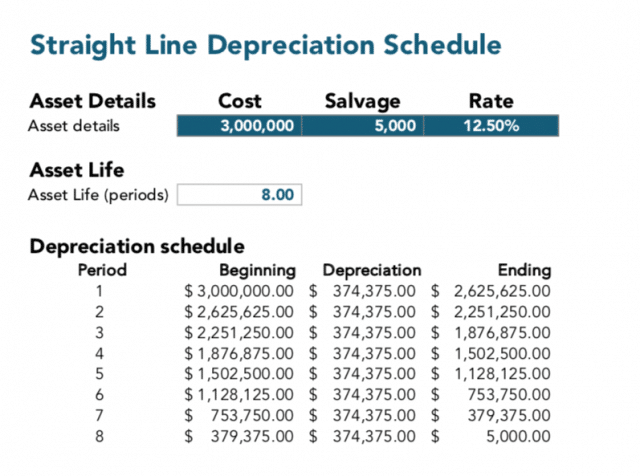

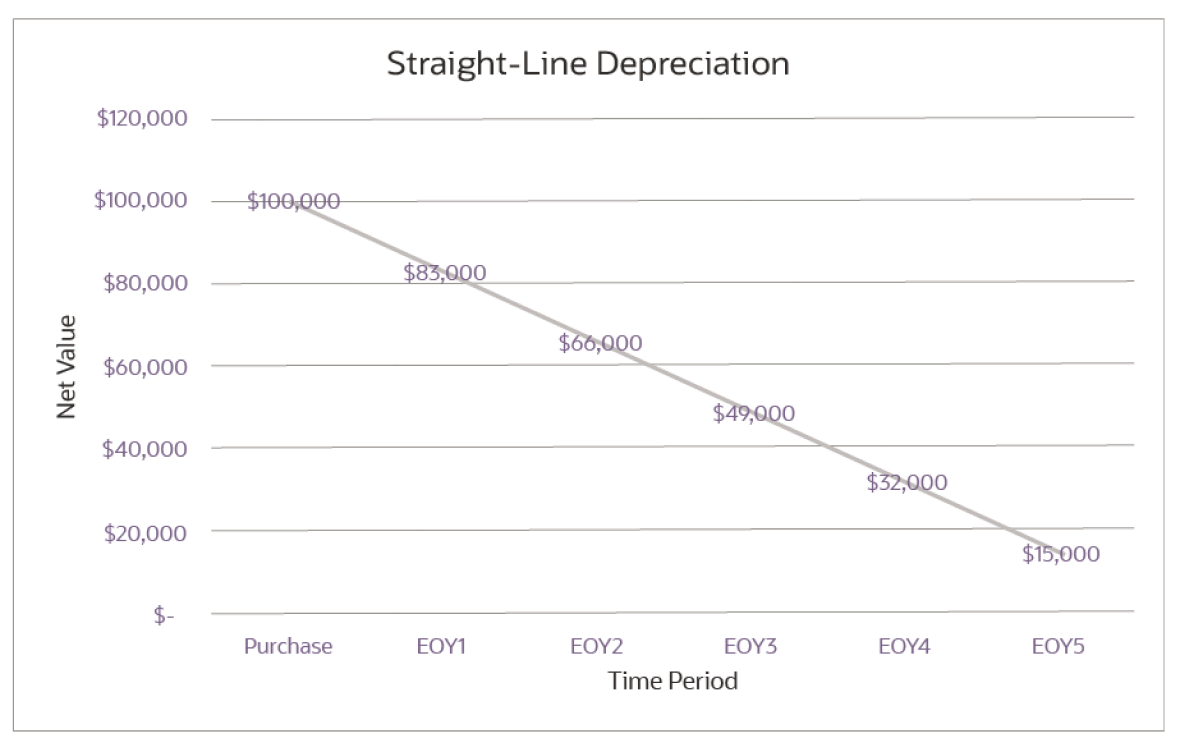

This method is no longer widely used so heres just a brief overview. 2 File Calculation services. Straight-Line Depreciation Formula First year depreciation M 12 Cost Salvage Life Last year depreciation 12 M 12.

Duke uses the straight-line method calculated on a monthly basis. Rated The 1 Accounting Solution. Effective interest rate calculation.

Under GAAP its important that depreciation is charged in full so the total amount of depreciation for the computers needs to add up to. Value of the right of. How is FASB GAAP depreciation calculated.

Pending Content System for filtering pending content display based on user profile. It subtracts the salvage value from the. Run the software on your PC or network sharing device.

Ad QuickBooks Financial Software For Businesses. Get Complete Accounting Products From QuickBooks. Straight line method is the simplest and one of the most common depreciation methods permitted under both FASB and IASB rules.

Accounting for the Tax Cuts and Jobs Act. FASB Response to COVID-19. Rated The 1 Accounting Solution.

The Governmental Accounting Standards Board GASB required for the first time that governments report as assets roads bridges dams and other structures along with.

Salvage Value Accounting Formula And Example Calculation Excel Template

The Facts And Figures Of Aircraft Depreciation

The Facts And Figures Of Aircraft Depreciation

The Facts And Figures Of Aircraft Depreciation

Limited Liability Companies Statement Of Financial Position Limited Liability Company Financial Position Financial

Depreciation What Method To Choose And Is None An Option

Understanding Generally Accepted Accounting Principles Gaap Backoffice 2022

Like Kind Exchanges Of Real Property Journal Of Accountancy

Depreciable Asset Lives The Cpa Journal

What Is Straight Line Depreciation Guide Formula Netsuite

2

The Basics Of Computer Software Depreciation Common Questions Answered

Leasehold Improvement Gaap Accounting Depreciation Write Off Efm

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Salvage Value Accounting Formula And Example Calculation Excel Template

How To Calculate Depreciation Expense For Business